Estimated Income for Covered California

Any financial subsidy through Covered California is based on what you expect your household income will be for the coverage year. When you estimate your income, you will need to include the entire household income including you, your spouse and anyone you claim as a dependent on your tax return.

You can begin by using your adjusted gross income (AGI) from your most recent federal income tax return, located on line 8b on the Form 1040. For those who are self-employed or unemployed, it is best to estimate as accurately as possible, and then report changes in income throughout the year.

If you file taxes in the following year and you collected financial subsidy you should not have, the amount you owe will need to be repaid back to the IRS.

Who is included in a household?

A household includes the primary tax filer, any spouse or tax dependents. Your spouse and tax dependents should be included even if they are not applying for health insurance.

You do not include anyone you do not claim as a dependent on your taxes. Covered California determines whether you get financial help by how much your household earns — not just the ones applying for health coverage.

How to Report a Change

When the information that you put on your application changes during the year, you must report it. Changes to things like your address, family size and income can affect your eligibility.

People with Medi-Cal must report changes to their local county office within 10 days of the change. If you have health insurance through Covered California, you must report changes within 30 days.

You must report a change if you:

- Get married or divorced,

- Have a child, adopt a child or place a child for adoption,

- Have a change in income,

- Get health coverage through a job or a program like Medicare or Medi-Cal,

- Move,

- Gain or lose a dependent,

- Have a change in tax-filing status,

- Have a change in citizenship or immigration status,

- Are incarcerated or released from incarceration,

- Have a correction to your name, date of birth or Social Security number,

- Experience any other changes that may affect your income and household size.

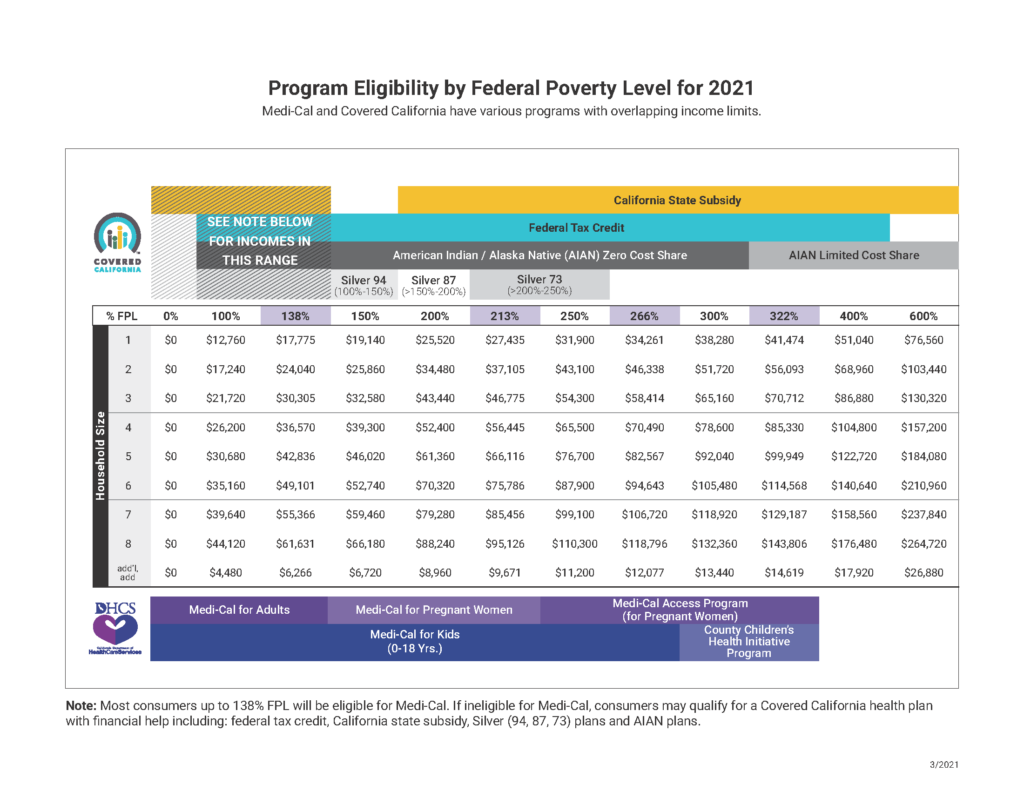

What is the federal poverty level?

The federal poverty level (FPL) is what Covered California uses to determine whether you will get financial help. It is a measure of income level issued annually by the U.S. Department of Health and Human Services. Federal poverty levels are used to determine eligibility for certain programs and benefits. In California, for example, Medi-Cal is available to most adults 19 to 64 years old who make up to 138 percent of the federal poverty level.