Understanding the income limits for Covered California is crucial for accessing affordable health insurance and maximizing your benefits. In particular, if you’re a California resident seeking assistance with health insurance plans, knowing whether your household income qualifies can significantly affect your coverage options and costs. Therefore, here’s a comprehensive guide to help you understand the Covered California income limits and how they impact your health insurance eligibility.

What Are Covered California Income Limits?

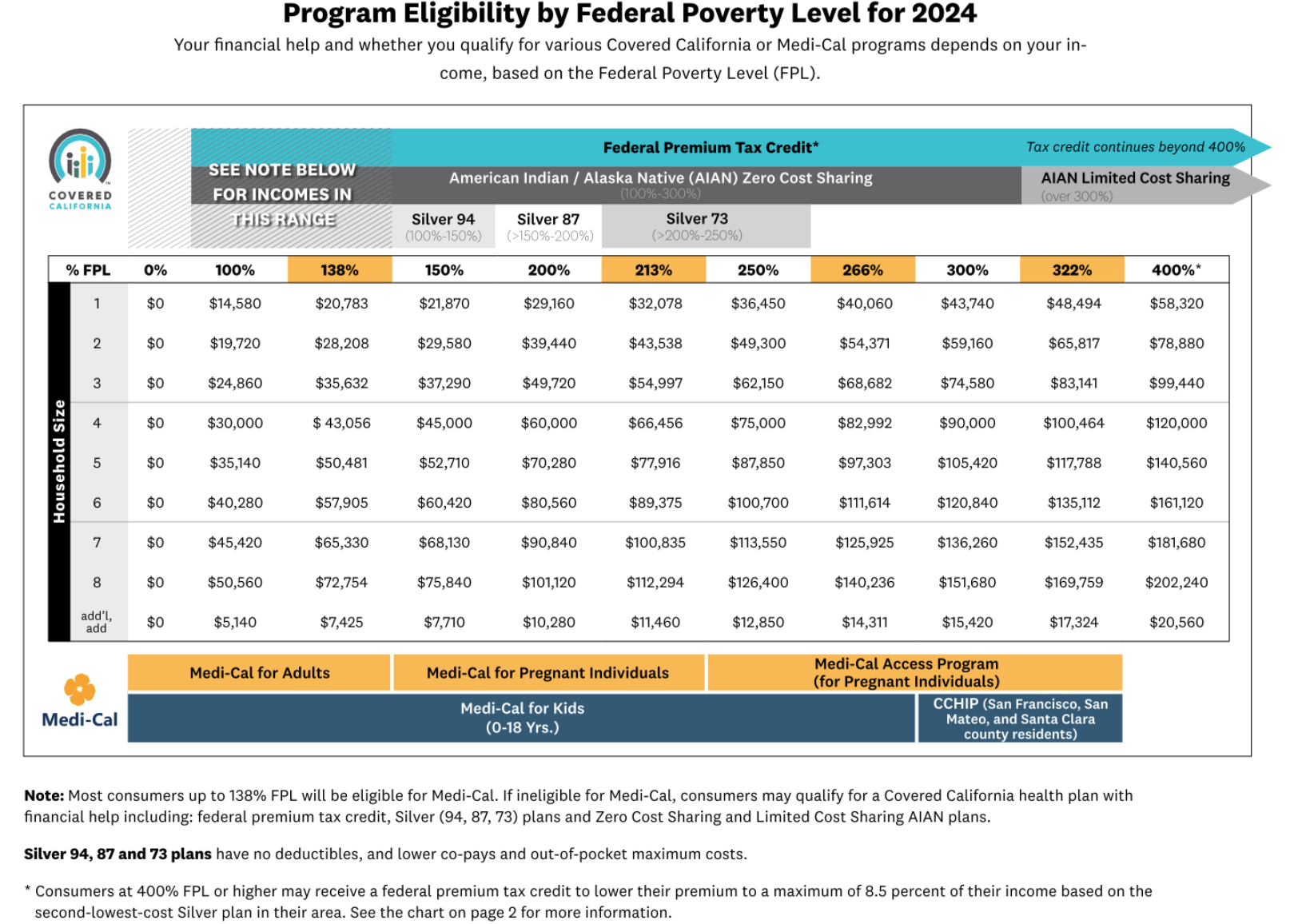

Covered California sets income limits based on the Federal Poverty Level (FPL) to determine eligibility for various health insurance subsidies and assistance programs. For 2024, households must have an income between 0% and 400% of the FPL to qualify for assistance. Additionally, these limits ensure that low-to-moderate-income Californians can access affordable health insurance coverage.

What counts as my income?

The Modified Adjusted Gross Income (MAGI) serves as the foundation for calculating income under the Affordable Care Act (ACA). Additionally, it’s important to ensure that your Adjusted Gross Income from your most recent Federal Tax Return aligns with the projected annual income on your Covered California application. Furthermore, if your dependent’s income surpasses the Income Tax Return Filing Threshold, you need to combine their MAGI with your own to determine the household MAGI that should be utilized for Covered California.

Why Understanding Income Limits Is Important

How do you properly calculate Covered California Income Limits?

1. Determine who is in your household

2. Add up all sources of income for all household members

3. Calculate your Modified Adjusted Gross Income (MAGI)

4. Determine your eligibility for financial assistance: If your MAGI falls within certain income brackets, you may be eligible for financial assistance through premium tax credits and cost-sharing reductions. These subsidies can help lower your monthly premiums and out-of-pocket costs.

How Income Limits Affect Your Coverage

Maximizing Your Benefits with Covered California

- Regularly Update Your Information: Continuously updating your income and household information is essential to avoid discrepancies and ensure you receive the correct subsidies. By keeping your details current, you can accurately assess your eligibility and avoid any potential issues that may arise from outdated information.

- Seek Professional Help: Consider working with a certified Covered California agent to navigate the complexities of health insurance options. At Skyline Benefit, we are an official Covered California storefront and certified agency that can help you understand your options and complete your application accurately. Our professional assistance ensures that you make informed decisions, taking full advantage of the benefits and subsidies available to you. Moreover, working with a certified agent provides you with personalized support, making the process smoother and more efficient.

Takeaway

Understanding the Covered California income limits is crucial for accessing affordable healthcare coverage. By staying informed, you can know your eligibility and benefits. Additionally, being proactive helps you take full advantage of available assistance programs.

Regularly updating your income and household information ensures you receive the correct subsidies. Staying informed and proactive allows you to maximize your benefits and ensure affordable healthcare coverage for you and your family through Covered California.

Looking for Assistance with Covered California?

Skyline Benefit is a certified insurance agency with Covered California. Act now and get the premium subsidy and coverage that you deserve.

Our agents can review your medical needs and budget, and tailor your health insurance options during Covered California Open Enrollment.

Call us now at (714) 888-5112