Are you wondering if your income qualifies for financial help with health insurance through Covered California? How do income limits work for premium subsidies or Medi-Cal? Understanding these thresholds can make a huge difference in securing affordable, quality coverage for you and your family.

The Covered California Income Limits for 2025 breaks down eligibility based on your household size and annual earnings, offering clarity on subsidies and programs available. Knowing where you stand can unlock substantial savings, whether you’re a single filer or managing a household of five. At Skyline Benefit, we’re here to simplify the process and ensure you take full advantage of every available program.

What Are the 2025 Income Limits for Covered California Subsidies?

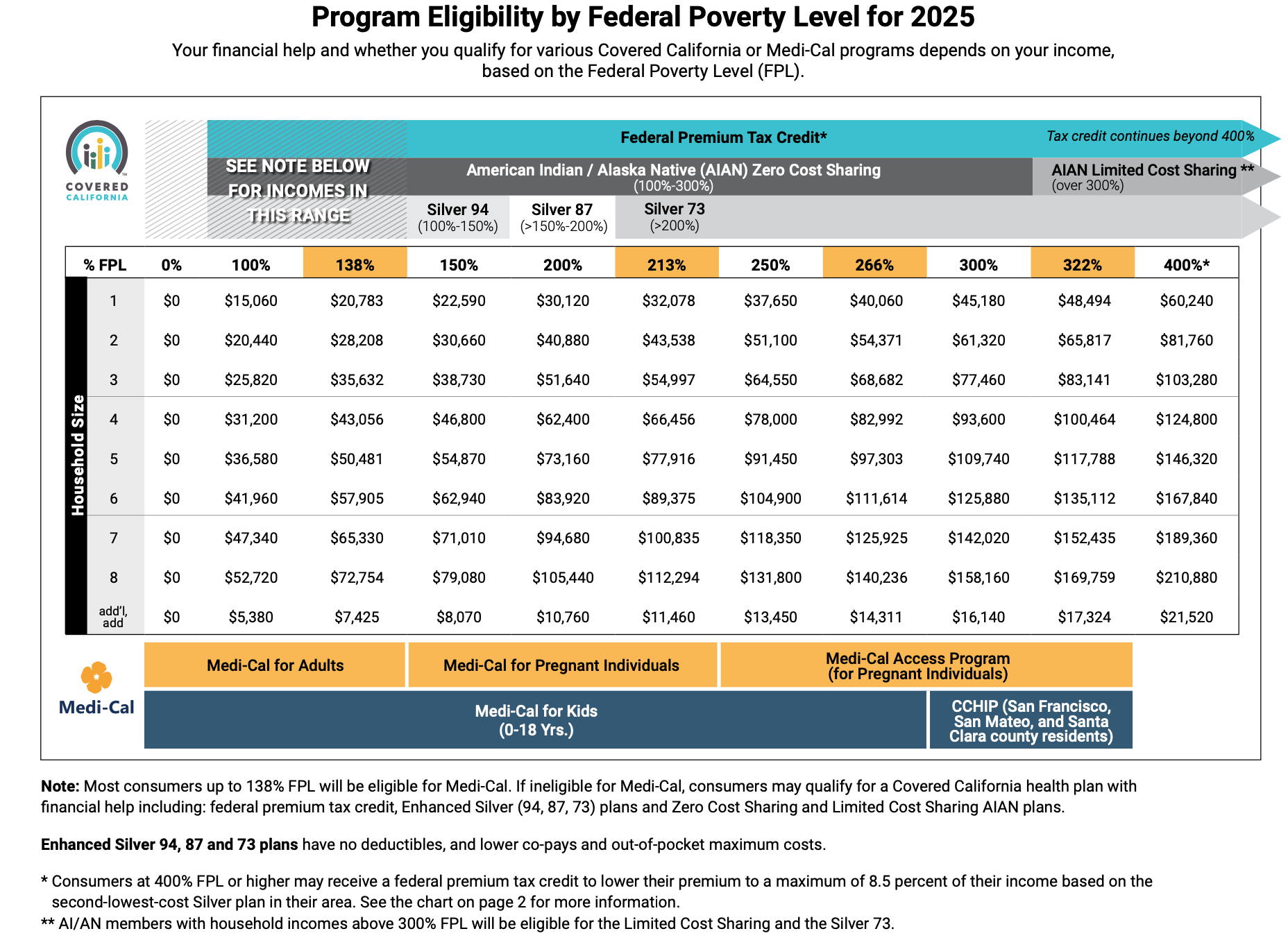

The 2025 income limits for Covered California subsidies are determined by the Federal Poverty Level (FPL). These limits help decide whether you qualify for assistance with premiums or other out-of-pocket costs.

Key Income Thresholds:

- Individuals: Income ranging between $20,120 and $54,360 may qualify.

- Families of Four: Annual income between $41,400 and $111,000 can be eligible.

If you’re earning above these thresholds but still find your premiums unaffordable, special provisions may apply to ensure coverage remains within reach.

What Are Enhanced Silver Plans, and Do You Qualify?

Enhanced Silver Plans are a special category of coverage designed for individuals and families with incomes between 138% and 250% of the FPL. These plans:

- Offer the same premiums as standard Silver Plans.

- Provide lower out-of-pocket costs, including reduced deductibles, copays, and coinsurance.

- They are only available if you qualify for cost-sharing reductions based on your income.

Enhanced Silver Plans are ideal for those needing frequent medical care or extra financial protection. If you qualify, choosing this plan can maximize your coverage while minimizing expenses.

How Does Household Size Affect Eligibility?

Your household size is one of the most significant factors influencing your eligibility for subsidies or Medi-Cal. The income threshold increases with the number of people in your household.

What Counts as a Household?

- The primary tax filer, spouse, and any dependents listed on the tax return.

- Any person who shares health coverage under the same plan.

Household Examples:

- Single Individual: If you earn $35,000, you may qualify for partial subsidies.

- Family of Three: A household income of $75,000 could secure significant savings.

- Family of Five: Even households earning up to $140,000 might find subsidies available.

Do I Qualify for Medi-Cal Based on My Income?

Medi-Cal serves as California’s comprehensive healthcare safety net for lower-income individuals and families. The free or low-cost program makes it accessible to many residents who meet the income criteria.

Medi-Cal Income Thresholds:

- Single Adults: Income under $20,120 annually qualifies for Medi-Cal.

- Families of Four: Households income below $41,400 are eligible.

Beyond income, other factors—such as pregnancy, disability, or being a foster youth—can also affect Medi-Cal eligibility.

How to Calculate Your Annual Income for Covered California

Accurately estimating your annual income is critical. Covered California uses your Modified Adjusted Gross Income (MAGI) to evaluate eligibility for subsidies or Medi-Cal.

Steps to Calculate Income:

- Start with Your Adjusted Gross Income (AGI): This is found on your federal tax return.

- Add Any Additional Income: Include Social Security payments, unemployment benefits, and investment income.

- Account for Household Changes: Predict income changes like a promotion, bonus, or job loss.

- Use Covered California’s Calculator: Tools provided by Covered California can help you estimate accurately.

Why Skyline Benefit Is Your Trusted Partner

Skyline Benefit is your one-stop solution for understanding Covered California income limits and enrolling in the right health plan. Here’s why Californians trust us:

- Tailored Guidance: We’ll analyze your household income and size to determine eligibility for savings or Medi-Cal.

- Step-by-Step Assistance: From applying to selecting the best plan, we handle the process for you.

- Expert Support: With years of experience, we’re always up to date with the latest changes in Covered California policies.

Let us help you get the health coverage you deserve without the stress.

Looking for Assistance with Covered California?

Skyline Benefit is a certified insurance agency with Covered California. Act now and get the premium subsidy and coverage that you deserve.

Our agents can review your medical needs and budget, and tailor your health insurance options during Covered California Open Enrollment.

Schedule a consultation today. Call us at: (714) 888-5112

Covered California quote