Covered California for Small Business Tax Credit 2025 helps small businesses save thousands on employee health insurance. If you’re an employer looking to provide affordable health benefits while reducing costs, this tax credit—available through Covered California for Small Business (CCSB)—can cover up to 50% of premium costs.

Understanding how much you qualify for and how to apply can be overwhelming, but that’s where Skyline Benefit comes in. As a trusted Covered California for Small Business broker, we help small businesses maximize their tax credits and choose the right health plans for their employees.

Who Qualifies for the Covered California for Small Business Tax Credit 2025?

To qualify for the Covered California Small Business Tax Credit 2025, businesses must meet the following criteria:

- Less than 25 full-time equivalent (FTE) employees

- Average employee wages below $62,000 per year

- Insurance must be bought through Covered California for Small Business

- Employer pays at least 50% of employee premiums

- The tax credit hasn’t been used for more than two consecutive years

Are you unsure if your business qualifies? Skyline Benefit can verify your eligibility and help you secure your tax credit.

How is the Tax Credit for Covered California for Small Business Calculated?

The Covered California for Small Business Tax Credit is calculated on a sliding scale based on:

- Number of Employees – Small businesses must have fewer than 25 full-time equivalent (FTE) employees to qualify.

- Average Annual Wages – Employees must earn an average annual salary of less than $62,000 (adjusted for inflation).

- Employer Contribution – Employers must contribute at least 50% of employee premium costs.

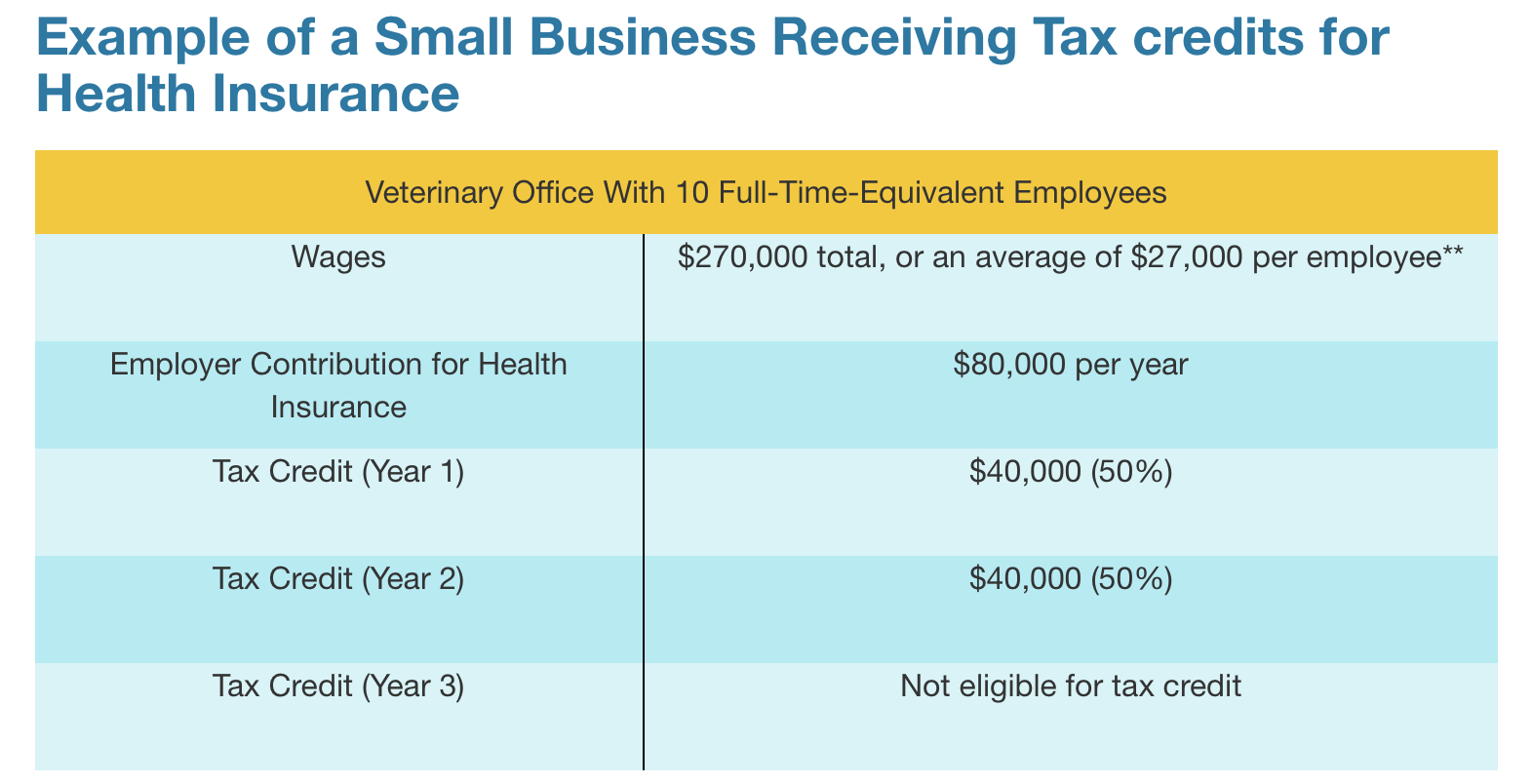

How Much Tax Credit Can a Small Business Get?

For Small Business Employers:

- Up to 50% of employer-paid premiums can be claimed as a tax credit.

- Example: If you spend $10,000 on employee health insurance premiums, you may receive up to $5,000 in tax credits.

For Small Tax-Exempt Employers (Non-Profits):

- Up to 35% of employer-paid premiums can be claimed as a tax credit.

- Example: If your organization spends $10,000 on health insurance, you may receive up to $3,500 in tax credits.

Even if you don’t owe taxes this year, small businesses may be able to carry the credit forward to apply it to future tax years.

How to Claim the Covered California for Small Business Tax Credit for 2025

Eligible small businesses can claim the CCSB tax credit by:

- Filing IRS Form 8941 – This form calculates your eligible tax credit.

- Attaching Form 8941 to your tax return when filing your business taxes.

- Carrying forward any unused tax credits if your credit exceeds your tax liability.

The tax credit is refundable for non-profits and tax-exempt organizations, meaning you can receive a direct payment from the IRS.

Need Help with Covered California Small Business Tax Credit 2025?

Skyline Benefit is a trusted Covered California for Small Business broker, helping small businesses across California access tax credits and enroll in affordable group health plans.

Our licensed agents can help you verify your eligibility and secure your tax credit.

Schedule a consultation today. Call us at: (714) 888-5112