Paying your Medicare premiums with the IRMAA surcharge in 2025 can be daunting, but it doesn’t have to be. For those with higher incomes, the Income-Related Monthly Adjustment Amount (IRMAA) adds another layer of complexity to your Medicare payments.

At Skyline Benefit, we specialize in guiding individuals through the intricacies of Medicare options. As Medicare insurance agents, we ensure that you receive the right attention and comprehensive support at every step of the way.

What is IRMAA (Income-Related Monthly Adjustment Amount)?

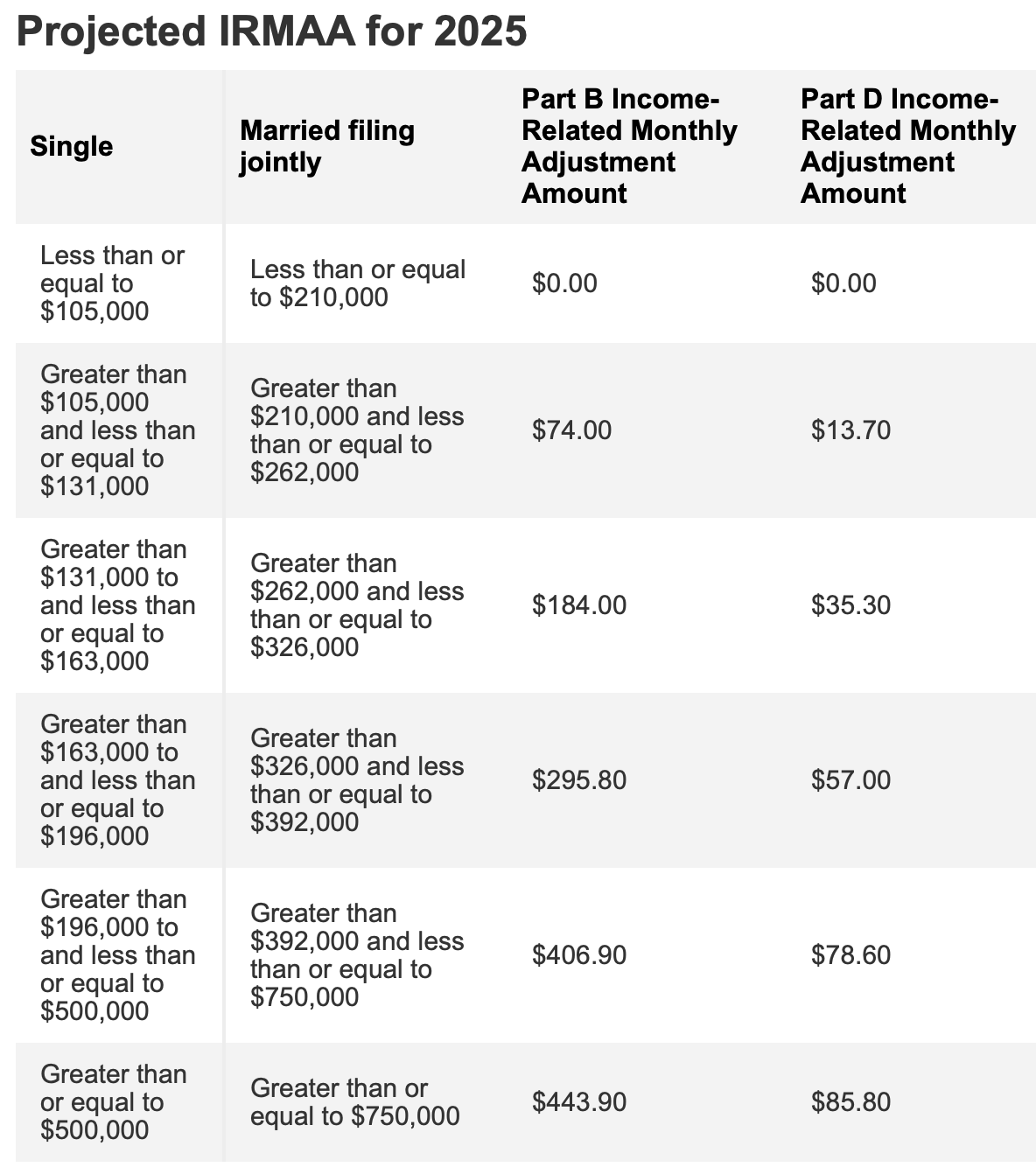

IRMAA is an additional premium that Medicare charges on top of the standard Medicare Part B and Part D premiums for individuals with higher incomes. Medicare calculates this surcharge annually based on income brackets and ensures that higher earners contribute more to their Medicare coverage. As a result, the 2025 IRMAA will be based on your 2023 tax return.

How much will be the Medicare Premium for 2025?

In 2025, we expect Medicare Part B premiums to increase. It is projected that the standard monthly premium will rise from $174.70 in 2024 to approximately $185 in 2025. This increase reflects adjustments for inflation and rising healthcare costs. Beneficiaries should anticipate higher monthly payments and plan their budgets accordingly.

How to Pay Your Medicare Premiums with IRMAA Surcharge in 2025

How Do You Pay Your Medicare Part B Premiums in 2025?

For most people, Medicare Part B premiums are automatically deducted from their Social Security benefits. You will not receive a separate bill if you are receiving Social Security benefits. However, if you are not receiving these benefits, you will receive a Medicare Premium Billing Statement (CMS-500) and must pay directly to Medicare.

Medicare Premium Billing Sample

How Do You Pay Your Medicare Part D IRMAA in 2025?

Medicare Part D IRMAA must be paid directly to Medicare, even if you receive your Part D plan through an employer or other provider. You will get a monthly bill from Medicare for your Part D IRMAA, which you can pay using one of the following methods:

- Online Payments: Through your secure Medicare account, using a credit card, debit card, or checking/savings account.

- Medicare Easy Pay: Sign up for monthly automatic deductions from your savings/checking account.

- Mail: Send a check, money order, or payment using a credit or debit card to Medicare.

What Happens if You Don’t Pay Your Medicare Premiums on Time?

All Medicare bills are due by the 25th of each month. To ensure your payment is received on time, submit your payment at least five days before the due date. If you fail to pay your premiums by the due date, you risk losing your Medicare coverage. If your Medicare is canceled, you must wait until January of the following year to reapply. Additionally, be aware that you will be subject to a lifetime penalty during the gap period.

Takeaway

Paying Medicare premiums with the IRMAA surcharge may seem daunting, but it becomes manageable with the right information and resources. Understanding your payment options and staying ahead of deadlines ensures you maintain your coverage without any issues. For further assistance, don’t hesitate to reach out to Skyline Benefit.

Need Assistance on How to Pay Your Medicare Premiums with IRMAA Surcharge in 2025?

Skyline Benefit is an independent Medicare insurance broker that offers affordable and flexible Medicare options. Selecting the best Medicare insurance plans and navigating open enrollment can be overwhelming; our mission is to simplify the process and help our clients every step of the way.

Schedule a consultation today. Call us at: (714) 888-5112