Small businesses looking to offer health insurance coverage to their employees can take advantage of the Small Business Health Options Program (SHOP), a part of Covered California. By participating in SHOP and meeting certain eligibility criteria, small businesses in California can also qualify for tax credits offered by the state. With Covered California for Small Business (CCSB), employers can choose the level of coverage that suits their budget and provide their employees with health insurance. Small businesses that purchase coverage through CCSB may also be eligible for a federal tax credit that can help offset the costs of providing health insurance.

How is the Tax Credit for Covered California for Small Business Calculated

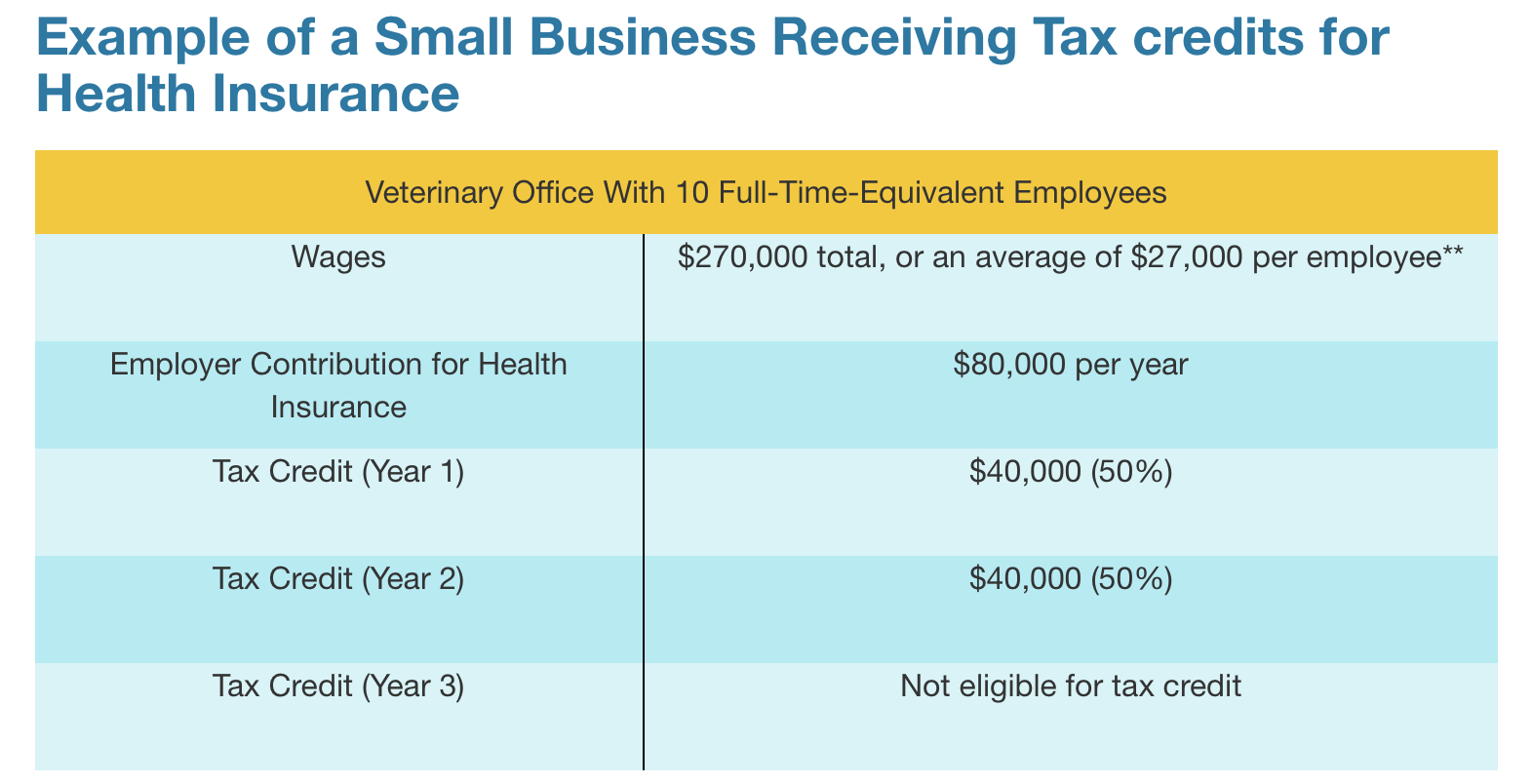

The Tax Credit for Covered California for Small Business is calculated based on a sliding scale. The credit amount is determined by the size of your business and the annual average wage. If your business is smaller and has a lower annual average wage, you are eligible for a larger credit.

How is my Tax Credit Determined

Small businesses must purchase health insurance through Covered California for Small Business (CCSB) to be eligible for the tax credits.

Your tax credit will depend on several factors, such as:

- Number of employees: The business must have at least 25 full-time equivalent employees (FTEs). Owners and immediate family members of the owner are not counted as employees when calculating the tax credit.

- Average wage of employees: The employees must have an average annual wage of less than $62,000 per year. This limit has been adjusted for inflation since 2014.

- Employer-paid premiums: The employer must contribute at least 50 percent of the cost of insurance coverage for each employee.

- Not have received the tax credit for more than two consecutive years

How Much Tax Credit is available to qualified Small Business

- For small business employers: You can get a tax credit worth up to 50% of the money you spend on premiums for your employees’ health insurance. So, if you spend $10,000 on premiums, you could get a credit worth up to $5,000.

- For small tax-exempt employers: This includes organizations like non-profits. You can get a tax credit worth up to 35% of the money you spend on premiums. So, if you spend $10,000 on premiums, you could get a credit worth up to $3,500.

How to Claim the Tax Credit

Small businesses can claim the tax credit by filling out Form 8941 and attaching it to their tax return. If you are a small business employer, you may be able to carry the credit back or forward. And if you are a small tax-exempt employer, you may be eligible for a refundable credit.

Benefits of the Tax Credit

Tax credit can help small businesses reduce their health insurance costs and provide better health insurance coverage to their employees. The tax credit can also help small businesses attract and retain employees by offering competitive health insurance benefits.

Unlocking the Potential of Tax Credits

Not all small businesses qualify for tax credits on healthcare benefits. Let our experienced experts at Skyline Benefit guide you in verifying your eligibility for federal tax credits. Remember, the credit is only applicable for two consecutive tax years based on premiums paid for employees. Don’t miss out on this opportunity to maximize your healthcare benefits and attract top talent to your small business.

Need Help with Group Health Insurance

Skyline Benefit is an independent health insurance broker in Fullerton, CA that offers affordable and flexible group health insurance options. Selecting the best group health insurance plans can be overwhelming; our mission is to simplify the process and help our clients every step of the way.

Schedule a consultation today. Call us at: (714) 888-5112