As we look forward to the 2025 Medicare Open Enrollment, it’s essential to stay informed about the anticipated adjustments in Medicare premiums and the Income-Related Monthly Adjustment Amount (IRMAA) for Parts B and D. Knowing these projections can help you plan your finances effectively and ensure you’re prepared for any additional costs. In this blog, we’ll delve into the projected Medicare premiums for 2025, specifically focusing on the IRMAA for Parts B and D.

What is IRMAA (Income-Related Monthly Adjustment Amount)?

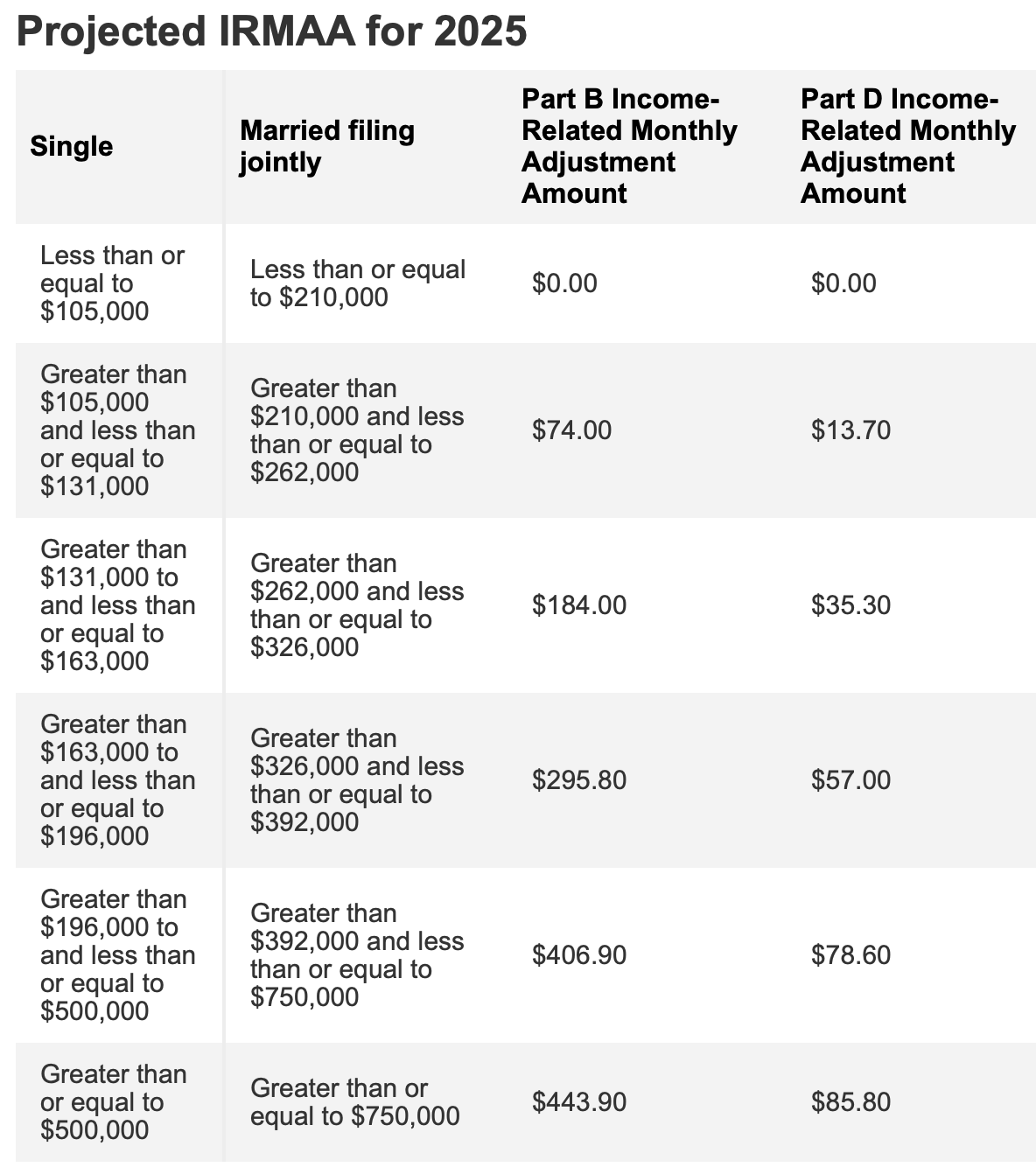

The IRMAA is an additional premium charged on top of the standard Medicare Part B and Part D premiums for individuals with higher incomes. Moreover, it is calculated annually based on income brackets, ensuring that higher earners contribute more to their Medicare coverage. The income thresholds for IRMAA are determined by your tax return from two years prior. Consequently, the 2025 IRMAA will be based on your 2023 tax return.

Projected Medicare Premiums for 2025

Medicare Part B premiums are expected to increase in 2025. Specifically, the standard monthly premium is projected to rise from $174.70 in 2024 to approximately $185 in 2025. This increase, therefore, reflects adjustments for inflation and the rising costs of healthcare services. However, beneficiaries should anticipate higher monthly payments and plan their budgets accordingly.

How Much is the Projected Medicare Parts B and D premium and IRMAA in 2025?

The projected IRMAA for Medicare Part B and Medicare Part D is determined using a sliding scale with five income brackets. Consequently, understanding these brackets is essential for financial planning. Here are the projected brackets and surcharge amounts for 2025:

How to Pay Your Medicare Part B and Part D IRMAA

Paying your IRMAA is straightforward. Specifically, the IRMAA is automatically added to your monthly premium bill for Medicare Part B. In contrast, for Medicare Part D, you’ll receive a separate bill from Medicare, which can be paid online, via mail, or through Medicare Easy Pay.

Planning Ahead: Strategies to Manage Your IRMAA

Managing your income to stay below IRMAA thresholds can save you significant money. Strategies like timing Both conversions and managing required minimum distributions can help you avoid the IRMAA surcharge. Consulting with Skyline Benefit, specializing in Medicare planning, can provide personalized strategies to optimize your income and minimize additional costs.

Takeaway

Understanding the projected Medicare premiums and IRMAA for 2025 is essential for effective financial planning. However, with the standard premium for Part B expected to increase and the IRMAA surcharges projected to rise, staying informed and planning will help you manage your healthcare costs more efficiently. At Skyline Benefit, we are dedicated to helping you navigate these changes and find the best Medicare plans to suit your needs. Schedule a consultation with us today to ensure you’re well-prepared for the upcoming changes in Medicare premiums and IRMAA.

Need Assistance During 2025 Medicare Open Enrollment Period?

Skyline Benefit is an independent Medicare insurance broker that offers affordable and flexible Medicare options. Selecting the best Medicare insurance plans and navigating open enrollment can be overwhelming; our mission is to simplify the process and help our clients every step of the way.

Schedule a consultation today. Call us at: (714) 888-5112