Are you looking for health insurance that fits your needs and budget? Finding the right plan can be challenging, especially with so many options out there. Fortunately, Blue Shield of California offers a variety of health insurance plans designed for flexibility and choice. Whether you prefer a plan that connects you with local healthcare providers or want more freedom to choose any doctor, Blue Shield has options that could work for you. Let’s explore what the 2025 Blue Shield Health Insurance Plans offer and how Skyline Benefit can guide you to the right choice.

2025 Blue Shield Trio HMO Plans

Blue Shield’s Trio HMO plans are ideal if you seek lower premiums and access to high-quality local providers. With networks that include top medical groups like Dignity Health, Hoag Memorial, Good Samaritan, and UC San Francisco, Trio HMO focuses on coordinated care to lower out-of-pocket costs.

- Primary Care Access: Trio HMO members select a Primary Care Physician (PCP) from the Trio HMO network, including in-person and virtual options. You can connect with your PCP via video or phone for routine care, preventive services, and specialist referrals.

- Coordinated Care: With a dedicated virtual care team, including a health coach, Trio HMO ensures coordinated support, helping you navigate your healthcare seamlessly.

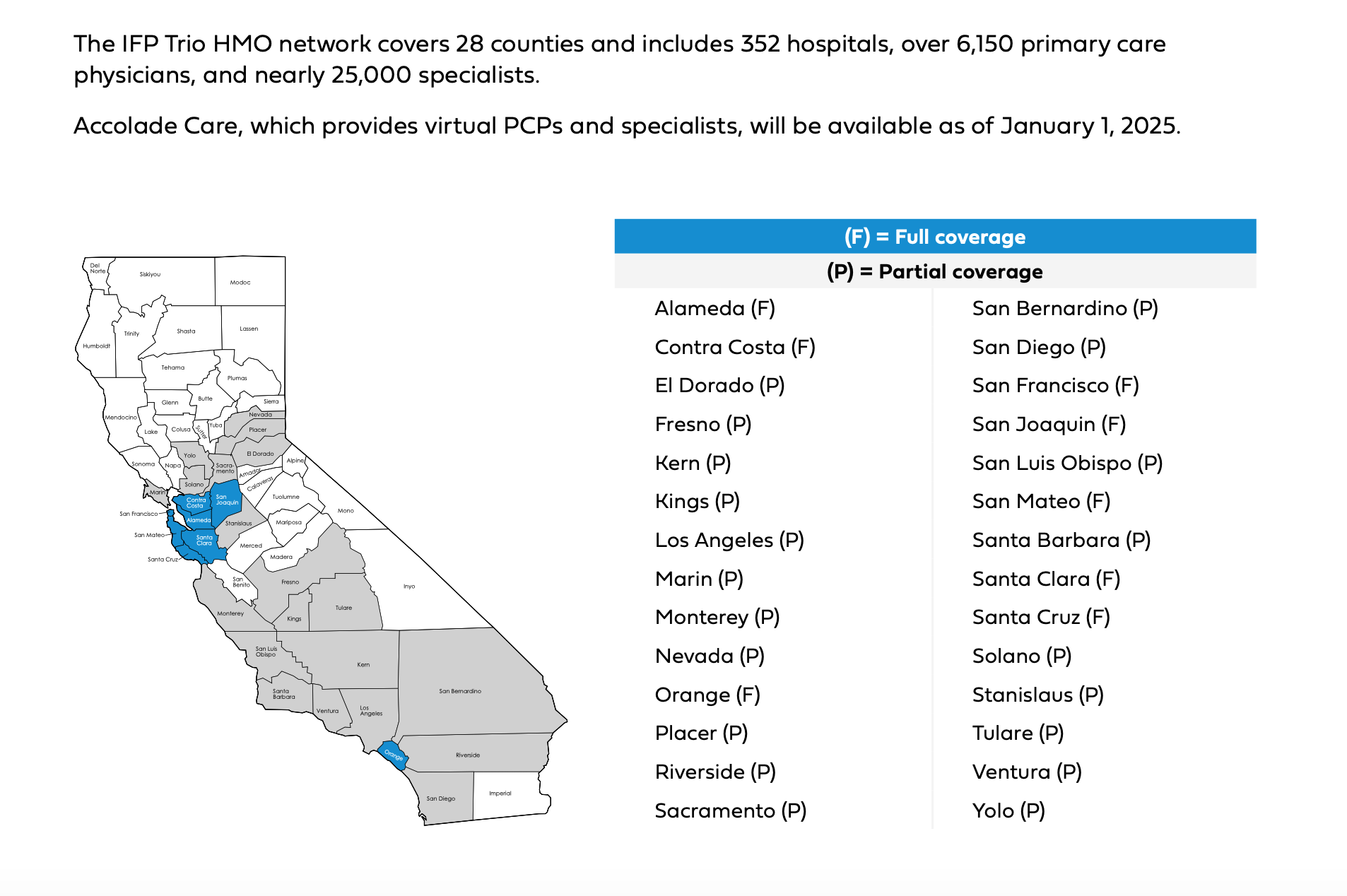

- Availability: Trio HMO plans are available across 28 California counties, providing extensive yet cost-effective coverage.

- Travel Coverage: Whether you’re traveling for work or leisure, Blue Shield HMO plan include BlueCard and Blue Shield Global Core, which give access to emergency and urgent care services throughout the U.S. and abroad.

2025 Blue Shield PPO Plans

Blue Shield’s PPO plans offer members the freedom to choose their own doctors, specialists, and hospitals without needing a referral. With a network of over 64,000 doctors and 330 hospitals, these plans are ideal for those who want more control over their healthcare.

- In-Network Savings: You’ll enjoy lower costs by using providers within Blue Shield’s Exclusive PPO Network. However, PPO plans also cover part of the cost for out-of-network providers, offering flexibility in choosing care.

- Virtual Access: Members can also connect with virtual doctors by video or phone from home, which is convenient for preventive care, diagnosis, and treatment.

- Travel Coverage: Whether you’re traveling for work or leisure, PPO plans include BlueCard and Blue Shield Global Core, which give access to emergency and urgent care services throughout the U.S. and abroad.

Health Plan Tiers: From Platinum to Minimum Coverage

Blue Shield offers a tiered approach to health plans so you can choose the level of coverage that aligns best with your healthcare needs and budget.

- Platinum and Gold Plans: If you’re someone who frequently needs healthcare, then Platinum and Gold plans might be the perfect fit. Not only do these plans come with higher monthly premiums, but they also provide lower copays and deductibles, making healthcare costs far more predictable. Additionally, these plans are ideal if you’re looking for comprehensive coverage with minimal out-of-pocket expenses.

- Silver Plans: For those with moderate healthcare needs, Silver plans offer a balanced approach between monthly premiums and out-of-pocket costs. Moreover, Blue Shield provides Silver cost-sharing plans through Covered California, which can further reduce deductibles and copays if you meet specific income requirements. Thus, Silver plans provide a great middle ground for affordability and coverage.

- Bronze Plans: On the other hand, if you only need occasional healthcare, Bronze plans could be the right choice. These plans offer affordable monthly premiums alongside higher out-of-pocket costs. In particular, options like the Bronze 60 HDHP PPO and Bronze 7500 HMO make these plans budget-friendly while still covering essential health needs.

- Minimum Coverage Plans: Finally, Minimum Coverage plans are designed for individuals under 30 or those with hardship exemptions. These plans provide essential protection at a low monthly cost, making them ideal for those who rarely need to see a doctor but still want peace of mind.

2025 Enrollment Date

Open enrollment for 2025 Blue Shield Health Insurance Plans starts on November 1st. This is your opportunity to secure health insurance that fits your needs, from comprehensive Platinum coverage to cost-effective Bronze options.

Need help with 2025 Blue Shield Health Insurance Plans?

Skyline Benefit is an independent health insurance broker in Fullerton, CA that offers affordable and flexible health insurance options. Selecting the best health insurance plans can be overwhelming; our mission is to simplify the process and help our clients every step of the way.

Schedule a consultation today. Call us at: (714) 888-5112