If you’re curious about the changes that will occur in 2024 Medicare premiums and IRMAA, it’s important to plan ahead for the expected costs. Specifically, if you have Medicare Part B and/or Medicare Part D prescription drug coverage.

It’s crucial to know the exact amount of your total monthly premium and income-related monthly adjustment amount (IRMAA), IRMAA for 2024 will depend on your tax return for 2022. Let’s take a closer look at the 2024 Medicare Premiums and IRMAA, so we can assess how much it may cost you.

What is IRMAA (Income-Related Monthly Adjustment Amount)?

IRMAA is an additional premium charged on top of the standard Medicare Part B and Part D premiums for individuals with higher incomes.IRMAA is calculated every year based on income brackets. Additionally, There are five income brackets, and your IRMAA amount increases as your income goes up.

It’s important to note that the income thresholds for IRMAA are set based on your filing status (individual or joint) and are subject to change annually with inflation. For individual filers, the income thresholds are topped at $500,000; for joint filers, the income thresholds are topped at $750,000.

What Determines the 2024 Medicare Premiums and IRMAA

The Social Security Administration (SSA) is responsible for determining who pays an IRMAA. Additionally, IRMAA calculations have a two-year lag time. This means that whether you need to pay IRMAA in a particular year depends on your income reported two years prior.

How Much is the Medicare Part B premium and IRMAA in 2024?

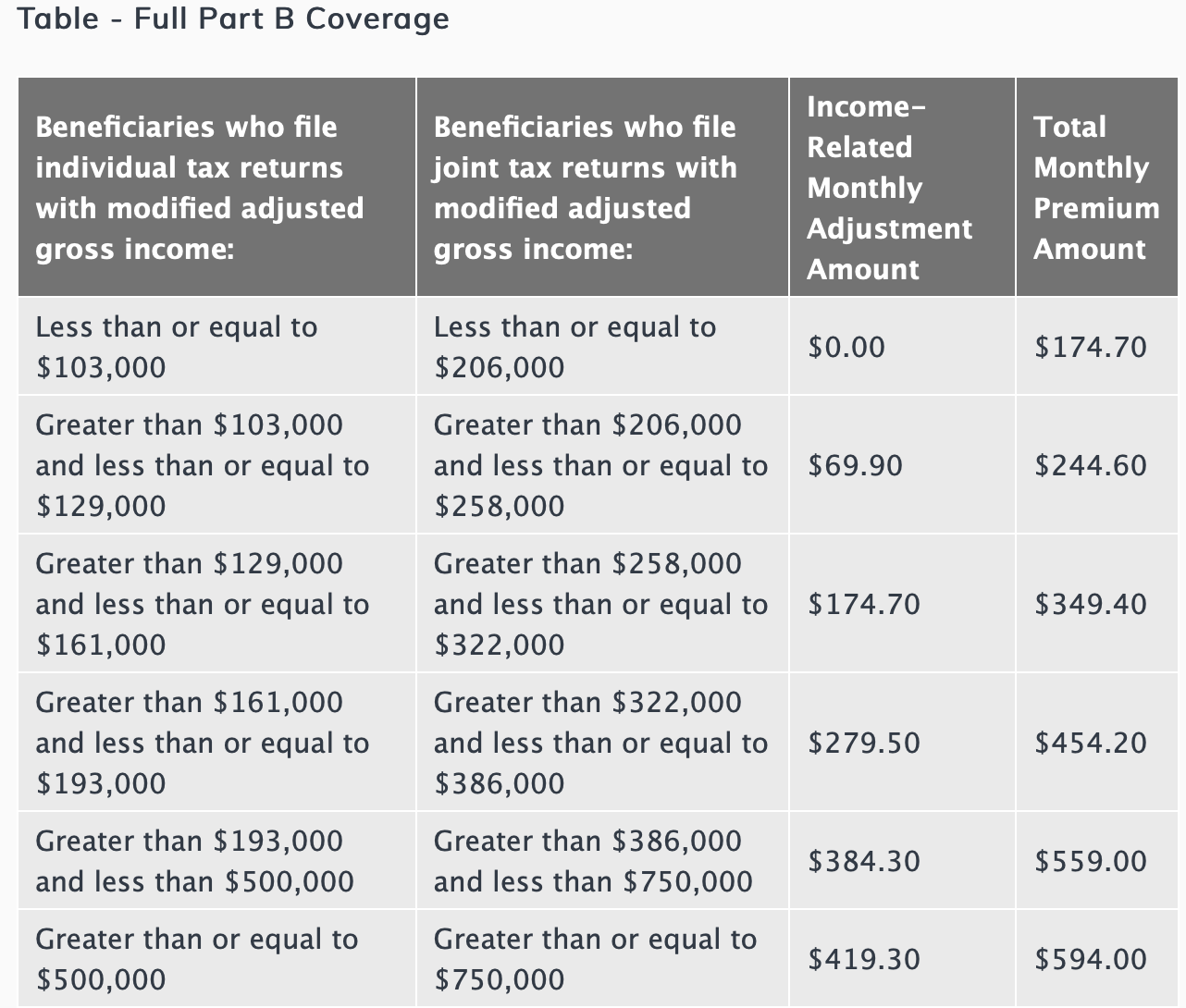

The standard monthly premium for Medicare Part B enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023.

Below is The 2024 Medicare Part B premium and IRMAA

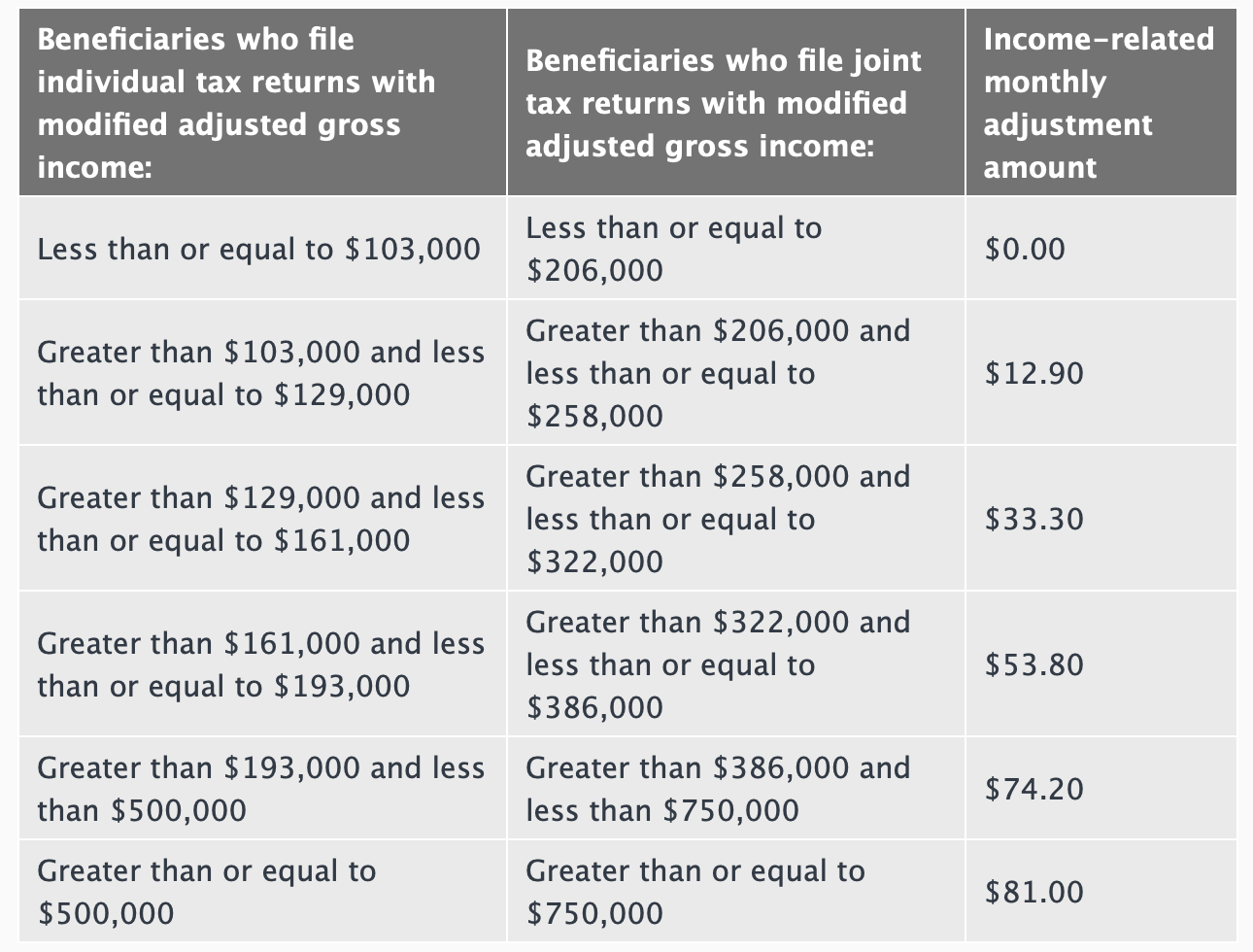

How Much is the Medicare Part D IRMA Amount in 2024?

Since 2011, a beneficiary’s Part D monthly premium has been based on an individual’s income. Moreover, the income-related monthly adjustment amounts are determined by the beneficiary’s modified adjusted gross income (MAGI) from two years prior. It’s worth mentioning that the MAGI includes income from various sources such as wages, self-employment, interest, dividends, and retirement distributions.

It’s easy to determine your 2024 Medicare total premiums by adding the IRMA amount to the 2024 premium costs.

How Can I pay my Medicare Part B and Part D IRMAA?

It is important to note that Medicare Part B IRMAA is automatically added to your monthly premium bill. On the other hand, Medicare Part D IRMAA is a different story. It must be paid directly to Medicare and not to your plan or employer. To make the payment, you’ll get a monthly bill from Medicare for your Part D IRMAA, and you can pay it through the following means below.

What means of payment are available to pay my IRMAA?

- You can pay online through your secure Medicare account using a credit card, debit card, or checking/savings account.

- Sign up for Medicare Easy Pay and let Medicare deduct your premium payments automatically from your savings/checking account each month.

- Mail your payment to Medicare using a check, money order, credit card, or debit card.

Need Assistance During Open Enrollment Period?

Skyline Benefit is an independent Medicare insurance broker that offers affordable and flexible Medicare options. Selecting the best Medicare insurance plans and navigating open enrollment can be overwhelming; our mission is to simplify the process and help our clients every step of the way.

Schedule a consultation today. Call us at: (714) 888-5112